Keith McCullough, the chief of Hedgeye Risk Management, has tweeted that he has a long BTC position open as Bitcoin has been climbing back above the $9,000 level.

BITCOIN: another great day for my Long position here (yesterday) seeing follow-through this AM pic.twitter.com/J4OIkCdfKL

— Keith McCullough (@KeithMcCullough) May 28, 2020

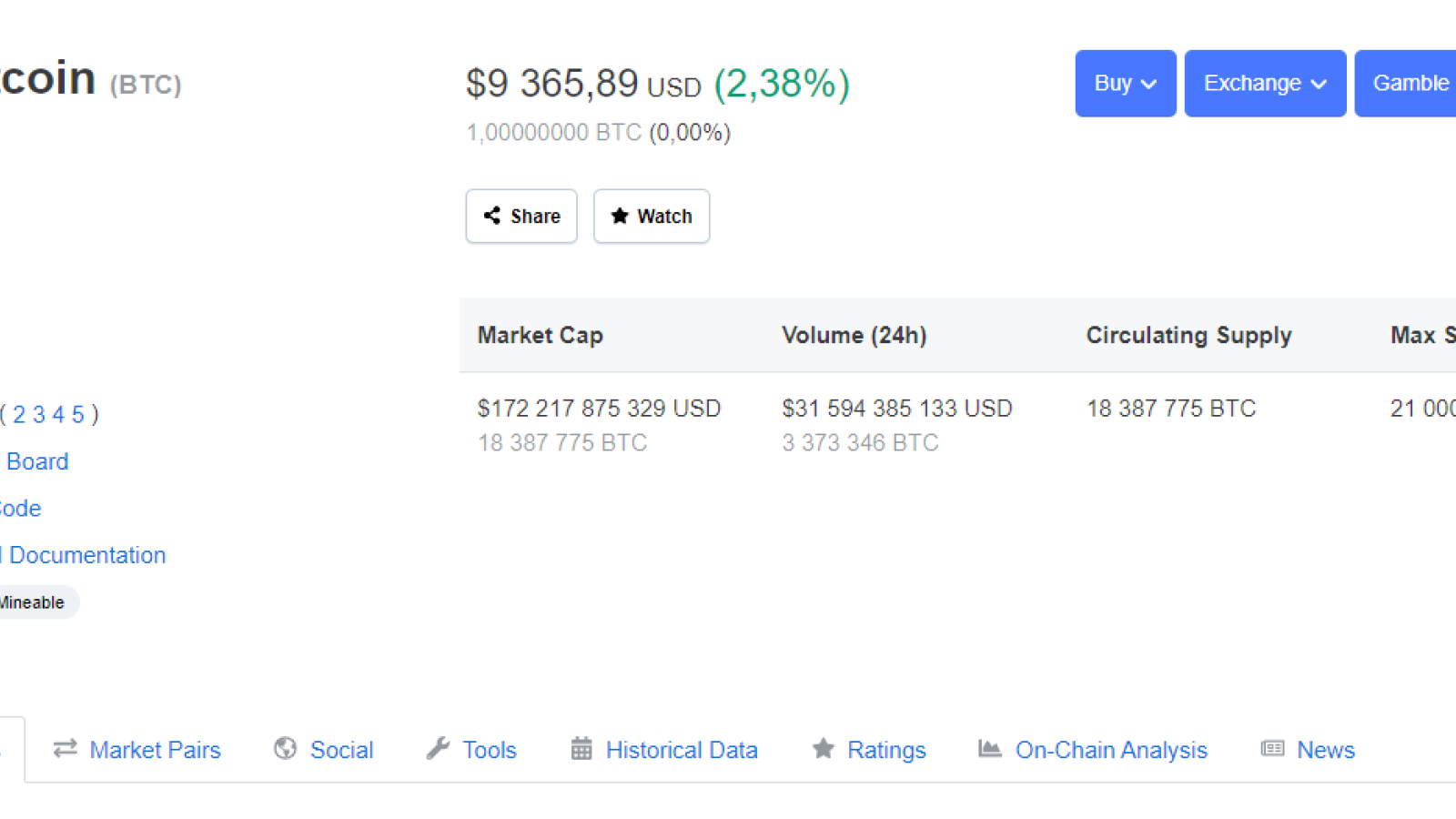

At press-time, the flagship cryptocurrency is trading at $9,365.

Keith McCullough vs. Warren Buffett

Keith McCullough, though not being a Bitcoin believer and considering BTC to be a regular commodity, is often bullish on BTC and does not slam it, unlike other major investors or CEOs of major financial companies.

One of the most famous BTC critics is the legendary investor Warren Buffett, who has often criticized it and has also been rejecting investments in gold.

This was recently shared by Robert Kiyosaki, who bashed Buffett for his old investment ideas. Kiyosaki stated that, at the moment, Buffett is sitting on a great amount of cash – $150 bln – and would not enter the stock market nor buy gold or Bitcoin.

US Congressional candidate criticizes Warren Buffett

Speaking of Warren Buffett, the congressional candidate David Gokhshtein took to Twitter a short while ago to express his take on Bitcoin and the importance of Warren Buffett in this regard.

Gokhshtein tweeted that BTC does not need Buffett’s blessing in order to be a success.

#Bitcoin doesn’t need Warren Buffett’s blessing in order to succeed.

— David Gokhshtein (@davidgokhshtein) May 28, 2020

Disclaimer: The opinions expressed by our writers are their

own and do not represent the views of U.Today. The financial and market information

provided on U.Today is intended for informational purposes only. U.Today is not

liable for any financial losses incurred while trading cryptocurrencies. Conduct

your own research by contacting financial experts before making any investment

decisions. We believe that all content is accurate as of the date of publication,

but certain offers mentioned may no longer be available.