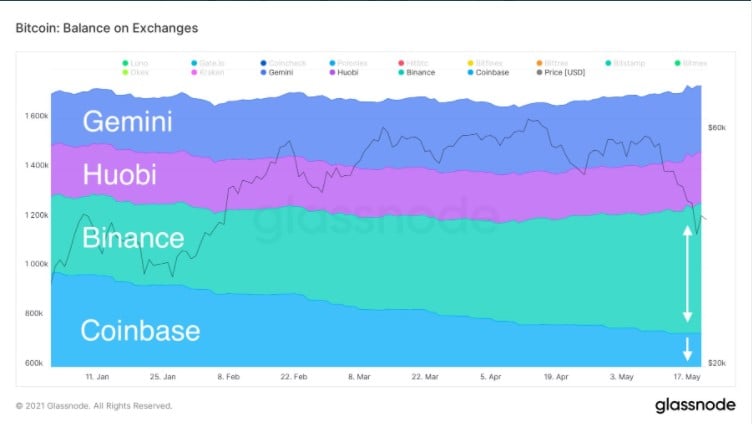

Charts provided by Glassnode data aggregator show that strong Bitcoin “dip buying” continues, while whales and institutions are withdrawing large amounts of Bitcoin from Coinbase in particular.

Bitcoin withdrawals from Coinbase higher than from other exchanges

Glassnode chart shows that on three major exchanges, except Coinbase, Bitcoin balances have been rising over the past two months.

The leading platform here is Binance, which has registered both the highest increase in BTC balances and a decrease. Next comes the Winklevoss twins’ Gemini, followed by the largest Chinese exchange, Huobi.

U.S.-based Coinbase is, on the contrary, demonstrating largely shrinking balances of the flagship digital currency.

Institutions continue strong BTC dip buying

Glassnode founders Jan Happel and Jann Allemann have taken to their joint Twitter account to share their take that financial institutions continue to massively buy Bitcoin on the dip.

They have posted a Glassnode chart that shows that the number of transfers from OTC desk wallets (seven-day MA) has been dropping.

Earlier, they reported that long-term holders had been actively accumulating Bitcoin as the Long-Term Holder Net Position Change indicator started going green.

Disclaimer: The opinions expressed by our writers are their

own and do not represent the views of U.Today. The financial and market information

provided on U.Today is intended for informational purposes only. U.Today is not

liable for any financial losses incurred while trading cryptocurrencies. Conduct

your own research by contacting financial experts before making any investment

decisions. We believe that all content is accurate as of the date of publication,

but certain offers mentioned may no longer be available.