JPMorgan Chase, the largest U.S. bank by total assets, notes that Bitcoin is eating away at demand for gold ETFs in a report shared by Michael Sonnenshein, the managing director of Grayscale Investments.

Institutional investors, such as family offices, now view the world’s largest cryptocurrency as a digital alternative to the yellow metal that used to be a go-to safe haven.

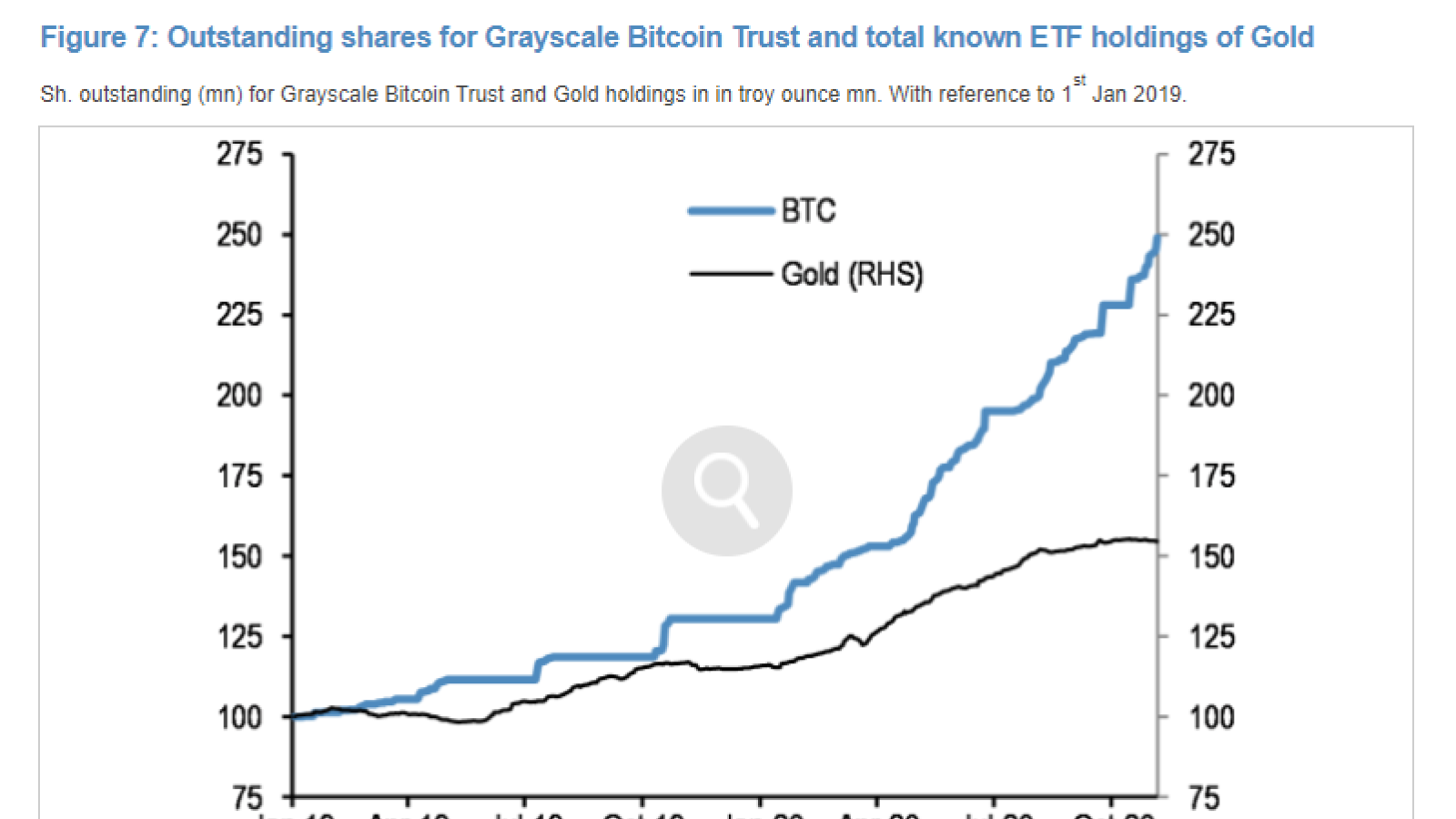

In October, the flow trajectory of the Grayscale Bitcoin Trust (GBTC) became significantly steeper while gold ETFs remained basically flat.

“This contrast lends support to the idea that some investors that previously invested in #gold ETFs such as family offices, may be looking at #bitcoin as an alternative to gold.”

In September, Bloomberg reported about Grayscale outperforming 97 percent of all U.S. ETFs.

The bullish report caps off a stellar week for the crypto asset management firm. According to Sonnenshein, his company recorded the largest raise across its suite of products that totaled $237 mln.

While GBTC remains by far its most popular investment vehicle, the Ethereum Trust is also gaining more traction with a record-shattering $58 mln.

Last month, Grayscale’ Ethereum Trust became an SEC-reporting company, meaning that it now has to file quarterly and annual disclosures with the U.S. securities regulator.

As reported by U.Today, Grayscale had more than $1 bln worth of inflows in the third quarter of 2020. Its year-to-date inflows are now nearing a whopping $3 bln. Overall, Grayscale has more than $9.1 bln worth of assets under management.