Chicago-based investment firm Marlton LLC is going after Grayscale due to the shares of the asset manager’s Bitcoin Trust slipping into discount territory.

According to an April 6 Bloomberg report, the family office is now demanding a tender offer to sell its stock at a higher price.

It is unclear how many shares Marlton has in its coffers.

“Destruction of value”

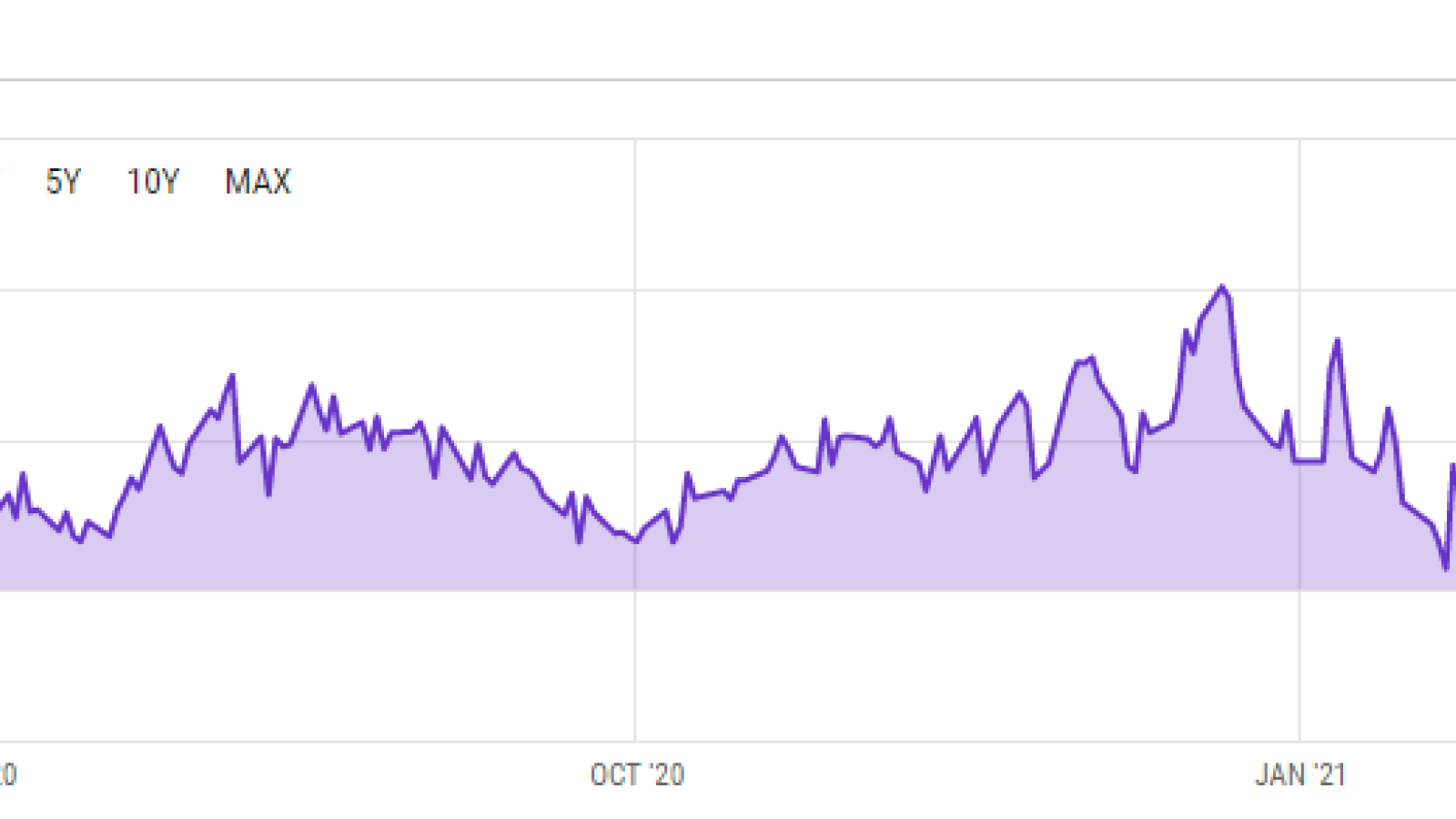

Grayscale Bitcoin Trust, the popular institution-oriented investment vehicle with over $38.1 billion worth of BTC under management, has now been trading at a discount to net asset value for well over a month, raising questions about the product’s future.

As reported by U.Today, the asset managed recently confirmed that it was seeking the blessing of the U.S. Securities and Exchange Commission to convert GBTC into an exchange-traded fund.

Such a prospect does not sit well with Marlton’s James Elbaor, who accuses the trust of destroying the stock value:

We are frustrated that the board might allow management to squander the company’s leading market share to the detriment of GBTC stockholders, whilst simultaneously rewarding yourselves handsomely with a profligate, market-leading, 2% management fee.

Disclaimer: The opinions expressed by our writers are their

own and do not represent the views of U.Today. The financial and market information

provided on U.Today is intended for informational purposes only. U.Today is not

liable for any financial losses incurred while trading cryptocurrencies. Conduct

your own research by contacting financial experts before making any investment

decisions. We believe that all content is accurate as of the date of publication,

but certain offers mentioned may no longer be available.