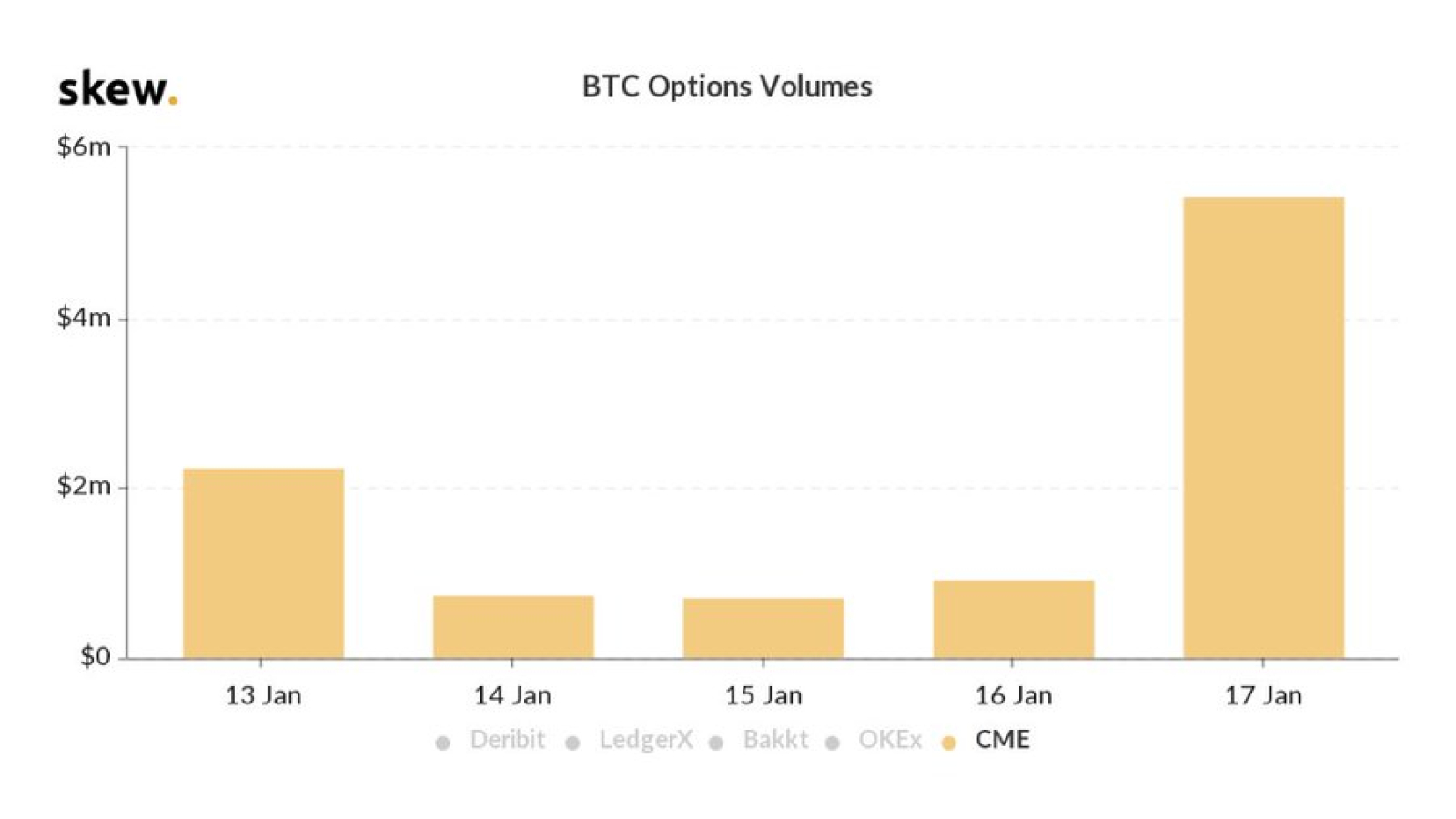

Bitcoin options that were launched by CME Group on Jan. 13 remain in great demand. According to data provided by Skew, a London-based crypto research boutique, 610 Bitcoin options (about 5.1 mln at today’s prices) were traded on Jan. 17 before the market closed.

Bakkt struggles to remain relevant

Bakkt became the first exchange to introduce regulated Bitcoin options that were greenlit by the CFTC. It launched BTC options along with cash-settled futures more than two months before CME Group.

However, at this point, it seems apparent that the ICE-backed venture is not even a serious competitor for CME Group anymore. As reported by U.Today, after its launch, the Chicago-based futures exchange managed to dwarf the total trading volume of Bakkt’s options in just one day.

According to research conducted by Oslo-based investment company Arcane Crypto, Bakkt even lags behind LedgerX, a startup that is still engulfed in a bitter beef with the CFTF.

card

Deribit continues to rule the roost

However, even despite its more than impressive start, CME Group still has a lot of catching up to do in order to compete with the likes of unregulated Dutch-based exchange Deribit.

On Jan. 14, for instance, CME traded only $730,000 worth of its contracts while a notional value of contracts traded on Deribit reached 14,829 BTC ($127 mln).

Will CME manage to compete with Deribit? Share your take in the comments!

Disclaimer: The opinions expressed by our writers are their

own and do not represent the views of U.Today. The financial and market information

provided on U.Today is intended for informational purposes only. U.Today is not

liable for any financial losses incurred while trading cryptocurrencies. Conduct

your own research by contacting financial experts before making any investment

decisions. We believe that all content is accurate as of the date of publication,

but certain offers mentioned may no longer be available.