According to data provided by CryptoCompare, cryptocurrency volumes have surged through the roof in Q1 with three consecutive months of growth.

Growing volumes might indicate that Bitcoin (BTC) might be readying for another bull run in 2020, which was recently predicted by Galaxy Digital CEO Mike Novogratz.

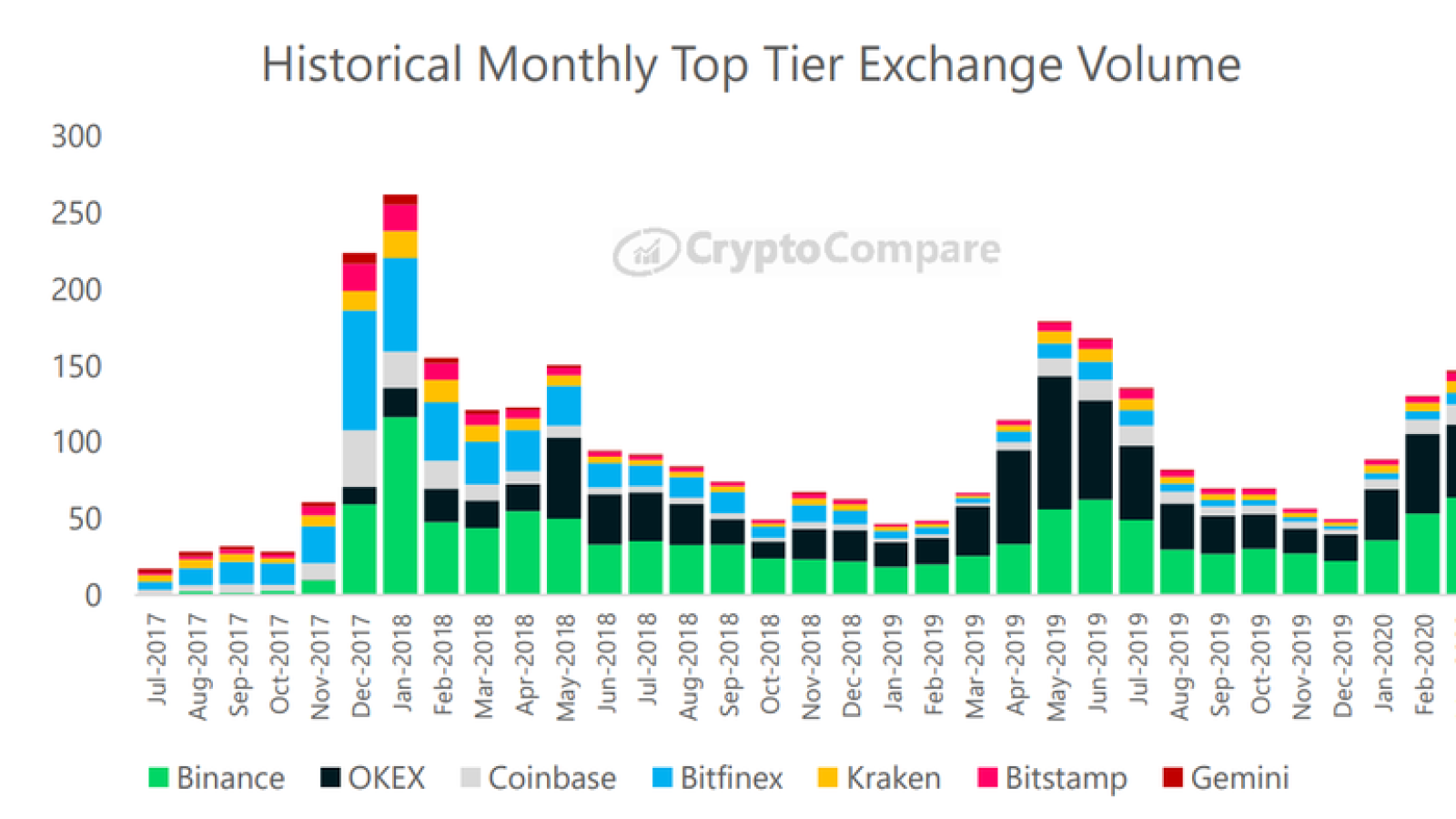

Spot exchanges record massive trading volumes

Despite Bitcoin’s abysmal price performance in March, top-tier exchanges have managed to increase their volumes by an impressive 35 compared to the previous month.

Notably, BTC seeing its highest daily volume to date ($75.9 bln) came hot on the heels of the most recent price crash.

As reported by U.Today, Bitcoin logged its third worst day in history after its price tanked 38 percent on March 12.

card

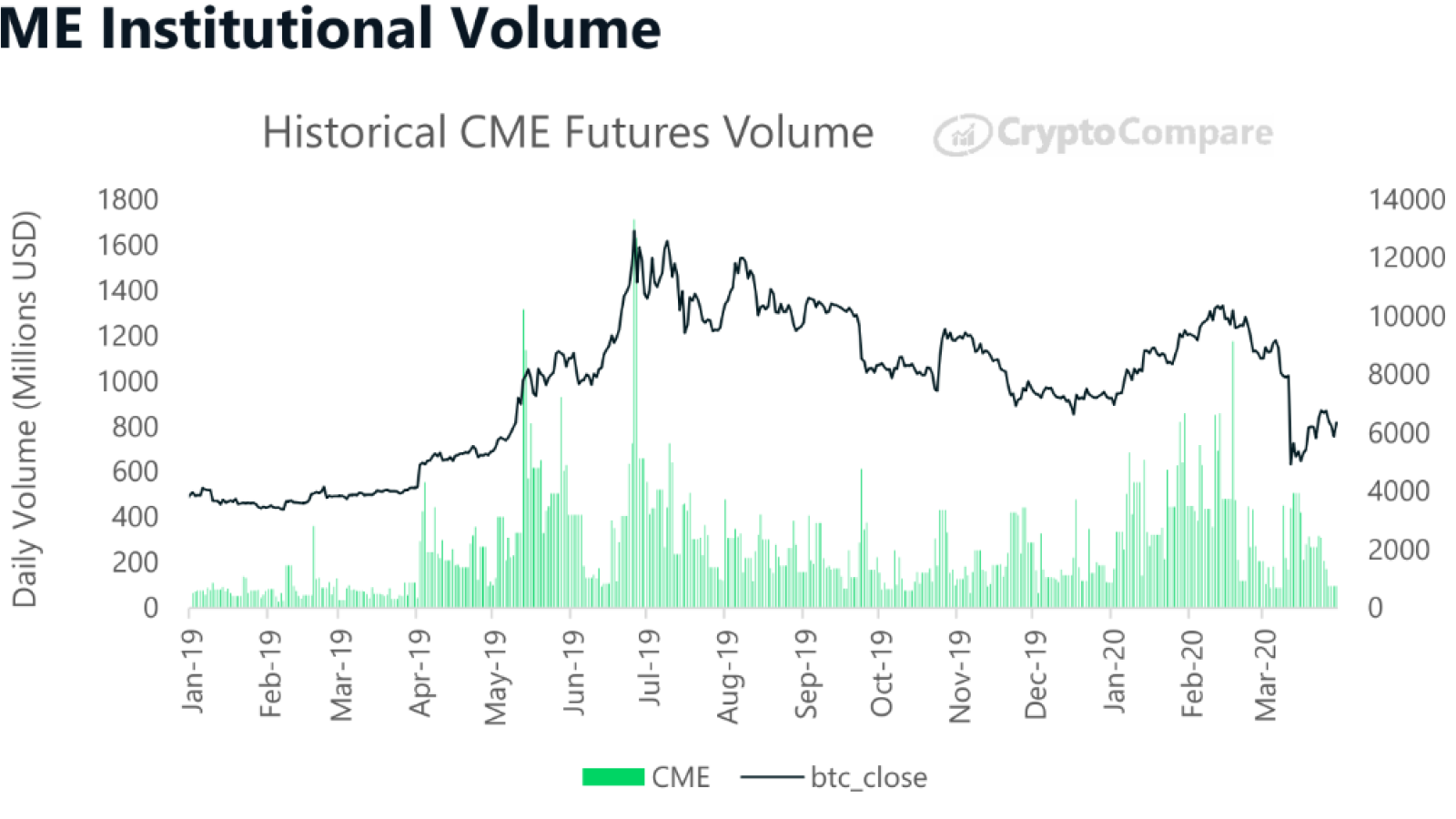

Institutional money is leaving the market

Another tidbit from the most recent CryptoCompare report is that the volumes of cryptocurrency derivatives reached a new all-time high in March. Antigua-based FTX was the biggest winner with a 94 percent increase in volume.

However, institutional traders have had a change of heart — CME Group recorded a massive 44 percent drop in volumes as a result of ‘Black Thursday.’

CME’s Bitcoin options volumes also pale in comparison to those of Deribit, which shows that traders prefer unregulated exchanges that offer them more leeway.

Disclaimer: The opinions expressed by our writers are their

own and do not represent the views of U.Today. The financial and market information

provided on U.Today is intended for informational purposes only. U.Today is not

liable for any financial losses incurred while trading cryptocurrencies. Conduct

your own research by contacting financial experts before making any investment

decisions. We believe that all content is accurate as of the date of publication,

but certain offers mentioned may no longer be available.