According to Bloomberg, the bulls have hit a snag after an impressive rally that ultimately sent the price of Bitcoin to its three-month high of $10,428 on June 1.

Its proprietary indicator shows that the top cryptocurrency is in the midst of forming ‘a selling pattern.’

card

$9,300 or $10,000?

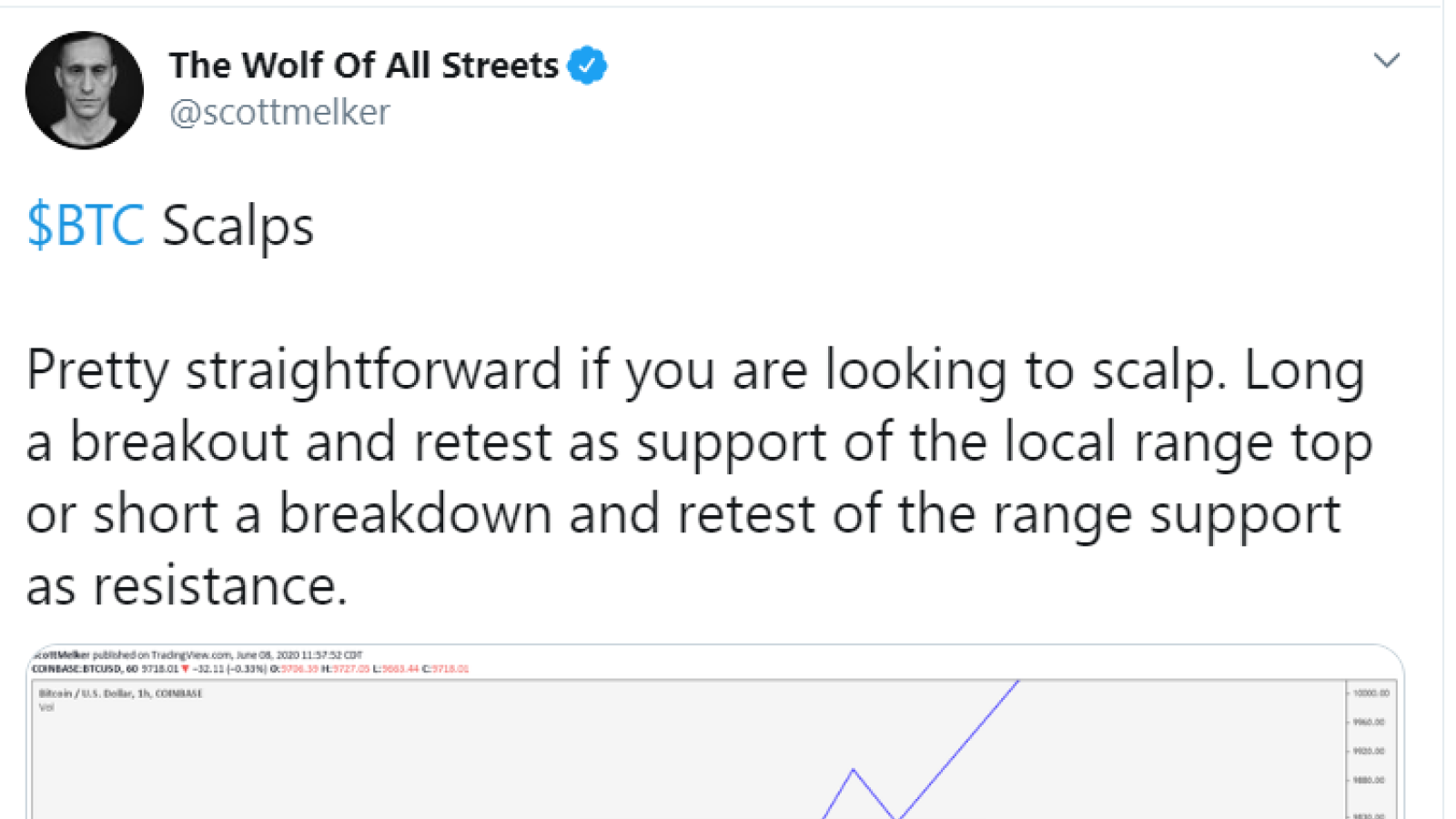

Meanwhile, cryptocurrency trader Scott Melker has outlined two scenarios of Bitcoin’s price action in the near future.

If the BTC manages to decisively break out of the recently formed range by surging above $9,800, the bulls will be able to push the price above the key level of $10,000.

Otherwise, the leading cryptocurrency could drop all the way to $9,300, and this will likely be followed by more downside.

As predicted by Kraken Intelligence, the benchmark cryptocurrency could collapse to $6,200 if it continues to get rejected at the pivotal resistance of a multi-year pennant.

A bullish year-end prediction

Despite the gloomy short-term prediction, Bloomberg expects the bulls to gain the upper hand this year.

In its monthly report called ‘Bloomberg Crypto Outlook,’ the company’s commodity strategist Mike McGlone forecasted that the BTC price could skyrocket to a new all-time of $28,000 by the end of 2020.

As reported by U.Today, McGlone recently tweeted that the top cryptocurrency was maturing into ‘a digital version of gold.’

Disclaimer: The opinions expressed by our writers are their

own and do not represent the views of U.Today. The financial and market information

provided on U.Today is intended for informational purposes only. U.Today is not

liable for any financial losses incurred while trading cryptocurrencies. Conduct

your own research by contacting financial experts before making any investment

decisions. We believe that all content is accurate as of the date of publication,

but certain offers mentioned may no longer be available.